The NHS is facing significant challenges in effectively utilising its allocated capital investment due to bureaucratic hurdles that are slow, unclear, and duplicative.

This is the key message from a new report by the NHS Confederation, which outlines how the current capital regime can be reformed to better support the government's missions for health and economic growth.

Local NHS leaders have expressed concerns that the capital approvals process, which involves multiple stages from local trusts and integrated care boards (ICBs) up through NHS England, the Department of Health and Social Care, and the Treasury, is excessively slow and duplicative. This cumbersome process creates delays and adds unnecessary costs, ultimately hindering the NHS's ability to repair estates, purchase vital equipment, and build new facilities.

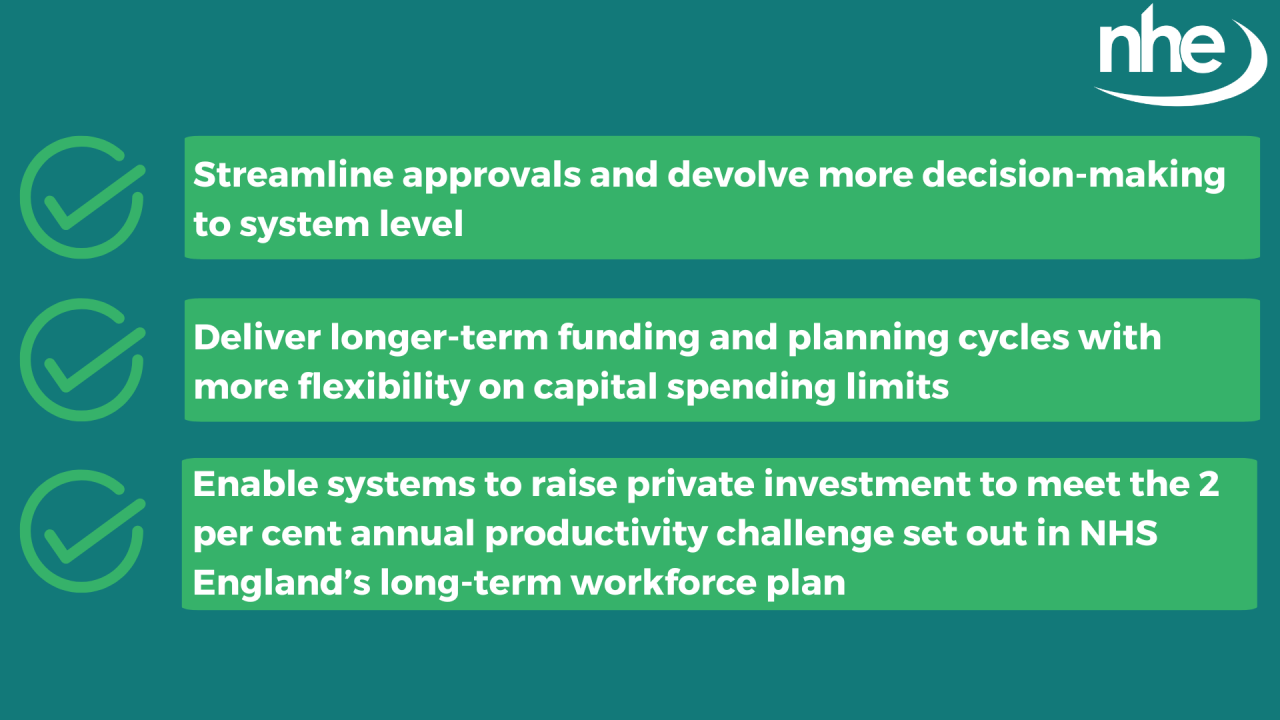

The report recommends a significant reduction in the number of approval stages, currently at least 19, to expedite project timelines. It also advocates for greater autonomy for local health systems over their spending. For instance, while both NHS England and the government must currently approve any investments over £50 million, the NHS Confederation suggests increasing this threshold to £100 million. This change would allow critical projects, such as new hospitals, advanced scanners, and artificial intelligence initiatives, to progress more swiftly.

The report, titled Capital Efficiency - How to Reform Healthcare Capital Spending, also highlights the need for ICBs to be permitted to raise additional investment through private means, which is currently prohibited. This recommendation follows Lord Darzi's report from the previous year, which revealed that the NHS has been deprived of capital funding for over a decade, resulting in a £37 billion shortfall.

Matthew Taylor, Chief Executive of NHS Confederation, said:

“Across the NHS, staff are having no choice but to treat patients in crumbling buildings and with out-of-date equipment. This is neither safe nor good for productivity. As Lord Darzi highlighted, the NHS has been starved for capital for more than a decade, so it is vital that it is able to maximise the return on every penny it has.

“But what money there is, is too often held back by red tape – creating delay and cost, undermining taxpayers’ value for money. The verdict from NHS leaders is clear: the NHS capital regime is broken.

“Our new report sets out 16 measures that can help the NHS make the most effective use of the capital funding it already has, including the extra investment promised by the government in the last Budget.

“Cutting the bureaucratic burden on NHS organisations getting approval to begin new projects is essential to avoid costly delays. Part of this is simplifying the process, but it also requires more autonomy to let local leaders get on and make the decisions that are best for their populations.

“But despite the very welcome increase in capital spending announced in the Autumn Budget, more funding will be needed to address all the issues. One option to bridge this gap is to allow new routes for private investment. This does not mean throwing open the doors to private finance, but creating the environment where the NHS has more options for raising the vital funding it needs to tackle its maintenance backlog and invest in the latest equipment and technologies.”

Despite the £3.1 billion additional capital investment announced in the Budget 2024, the NHS still faces a shortfall of at least £3.3 billion to meet the £6.4 billion annual capital investment required to boost productivity growth to 2% per year. Successive governments have exacerbated this issue by diverting capital budgets to cover day-to-day revenue spending.

This new report builds on a previous briefing paper that outlined various methods for the government to raise further capital funding, including through private sector partnerships. The NHS Confederation's recommendations aim to ensure that the NHS can maximise the return on every penny of its capital investment, ultimately improving patient care and supporting economic growth.

Image credit: iStock